English Corner

How to Invest in Vietnamese Stock Market 2026?

How to Invest in Vietnamese Stock Market 2026: A Complete Guide for Beginners

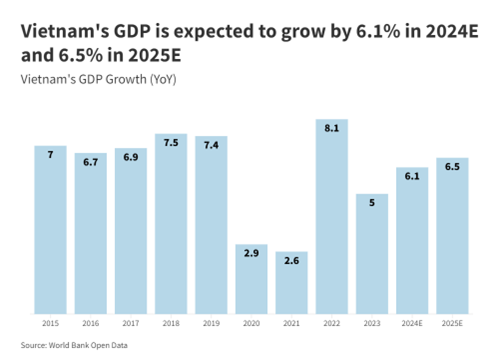

Investing in the stock market is one of the smartest ways to grow your wealth over time. As Vietnam continues to be one of the fastest-growing economies in Asia, more and more investors are interested in the opportunities here. If you are wondering how to earn profits in this potential stock market, this comprehensive guide will help you understand all the essential steps, strategies, risks, and trends you should be aware of in 2026.

Whether you are a foreign investor looking for high-potential emerging markets or a Vietnamese beginner trying to build your financial future, this article will give you everything you need to get started.

-

Why Invest in Vietnam Stock Market in 2026?

Vietnam’s economy has shown strong resilience in recent years. The country benefits from:

- Stable economic growth

- Large and young workforce

- Increasing foreign direct investment

- Strong domestic consumption

- Government support for digital transformation and financial reform

These factors make Vietnam an attractive destination for investors. By 2026, the stock market is expected to expand significantly thanks to:

✔ Upgrade from “Frontier Market” to “Emerging Market” status (highly expected)

✔ Digital trading improvements

✔ More transparent regulations

✔ The participation of global investment funds

Thus, learning how to invest in Vietnamese stock market early gives you a huge advantage before major global capital flows arrive.

-

Understanding the Vietnamese Stock Market Structure

Before investing, you should know the three main exchanges in Vietnam:

| Exchange | Location | Focus |

| HOSE | Ho Chi Minh City | Large & mid-cap companies |

| HNX | Hanoi | Smaller companies & bond market |

| UPCoM | Hanoi | Companies transitioning to listing |

Most stable and reputable companies trade on HOSE, so beginners often start there.

-

Who Can Invest in Vietnam Stock Market?

Both Vietnamese citizens and foreigners are allowed to invest. The conditions vary slightly:

Vietnamese Investors

- Must be over 18 years old

- Have a valid ID card or citizen ID

- Open a securities trading account

Foreign Investors

- Must obtain a trading code issued by Vietnamese authorities

- Open a trading account via a licensed brokerage

- Comply with foreign ownership limits in certain industries

Foreigners increasingly ask how to make investment in this stock market, and the process is becoming simpler every year.

-

How to Invest in Vietnamese Stock Market: Step-by-Step

Here is the complete checklist for beginners:

Step 1 — Choose a Reputable Brokerage Firm

Look for brokers that offer:

- Low fees

- Good trading platform

- Customer support

- Research reports

Examples include major Vietnamese securities companies and international brokerages operating in Vietnam.

Step 2 — Open a Securities Trading Account

You will need to provide:

- Identification documents

- Bank account information

Within 1–3 days, your account is ready.

Step 3 — Deposit Money into Your Trading Account

You can transfer VND directly from your bank.

For foreign investors:

Many brokers support foreign currency conversion.

Step 4 — Research Companies and Opportunities

Understand:

- Business model

- Financial performance

- Competitive advantages

Step 5 — Place Buy/Sell Orders

Choose between:

- Market order → Buy at the current price

- Limit order → Buy only at your target price

Step 6 — Monitor and Manage Your Portfolio

Review your investments regularly and adjust based on market conditions.

-

What to Invest in? Types of Stocks in Vietnam

When thinking about how to invest in Vietnamese stock market, you should consider sectors with strong growth potential such as:

- Banking and Finance

- Real Estate & Industrial Parks

- Consumer Goods & Retail

- Information Technology

- Renewable Energy

- Logistics & Transportation

Additionally, Vietnam offers:

- Blue-chip stocks → stable & long-term growth

- Mid-caps with higher growth possibilities

- Dividend stocks for passive income

Beginners should diversify rather than investing all money in one company.

-

Investment Strategies for 2026 (How to Invest in Vietnamese Stock Market)

Here are recommended strategies depending on your goals:

| Strategy | Best For | Description |

| Long-term investing | Stable returns | Hold quality stocks for 3–5 years |

| Value investing | Buying undervalued stocks | Focus on strong fundamentals |

| Growth investing | Younger investors | Prioritize fast-growing companies |

| Dividend investing | Passive income | Choose companies with steady dividends |

| ETFs & Funds | Beginners | Professional management, lower risk |

Long-term strategy is ideal for those exploring how to invest in Vietnamese stock market with lower stress and better stability.

-

Risks to Consider Before Investing

No market is risk-free. Key risks in Vietnam include:

- Market volatility

- Economic slowdown

- Regulatory changes

- Limited transparency in some sectors

- Global financial uncertainty

Always research carefully and avoid following rumors.

Never invest money you cannot afford to lose.

-

Tax Rules for Stock Investors

Depending on your activity:

| Type of Profit | Tax Rate |

| Selling stock (capital gains) | 0.1% on selling value |

| Dividends | 5% withholding tax |

Understanding tax policy is important for everyone learning how to invest in Vietnamese stock market efficiently.

-

Future Outlook: Why 2026 Is a Golden Opportunity

By 2026, the market is expected to:

- Attract billions of dollars from global funds

- Improve liquidity and accessibility

- Have more high-quality listed companies

- Enhance transparency and investor protection

Investing early offers the chance to benefit the most from this growth.

Read more: Are you looking to improve your English ‘s fluency?

-

Tips for Beginners (How to Invest in Vietnamese Stock Market)

Here are quick reminders:

✔ Start small and learn gradually

✔ Focus on companies you understand

✔ Avoid emotional trading

✔ Diversify your portfolio

✔ Keep learning from reliable sources

Knowledge + Patience = Profit

Conclusion

Learning how to invest in Vietnamese stock market is not as complicated as many people think. With a fast-growing economy and an expanding financial system, Vietnam offers huge opportunities for investors in 2026 and beyond.

Start today — the earlier you invest, the greater your potential wealth in the future.

If you are ready to take action, choose a trusted brokerage, study the market carefully, and build a strategy that matches your goals. The Vietnamese stock market could become one of the most rewarding investment destinations in Asia. Don’t miss your chance!

You may also like:

Best investment opportunities in VN for the next coming years

Top 10 stationery brands in the word for 2026